What’s the better financial vehicle in which to leave a charitable donation when I pass away? Should I purchase a CD / Annuity, or use a Whole Life Insurance policy instead?

Well, the answer depends on your age, your health, and how long you live – the latter of which we simply do not know.

John is a healthy 70 year old male. John has $100,000 liquid that he doesn’t need to live on, and want to make sure this money goes to his church upon his passing.

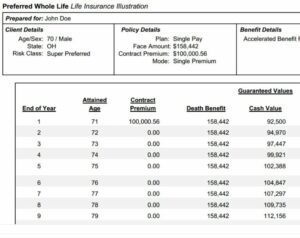

If John took that $100,000 in cash and placed it in a single premium whole life policy, it’s estimated that day one John’s death benefit would be a little more than $158,000. That would be an immediate increase in his gift to the church by $58,000, or 58%.

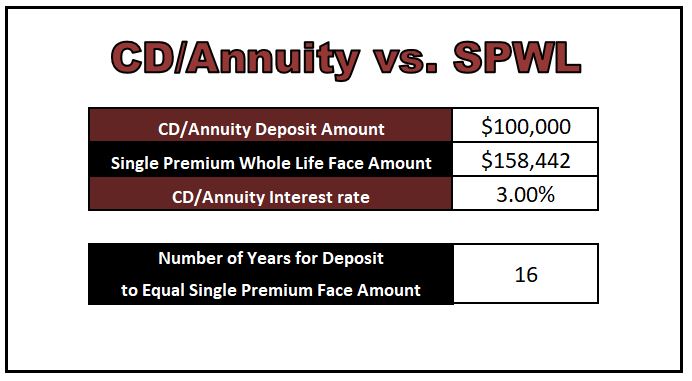

If John instead placed this money in a long term CD or annuity at a guaranteed 3.0% interest rate it would take sixteen years, or when John reaches 86, before the balance of the account reached $158,000.

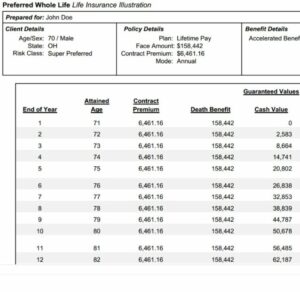

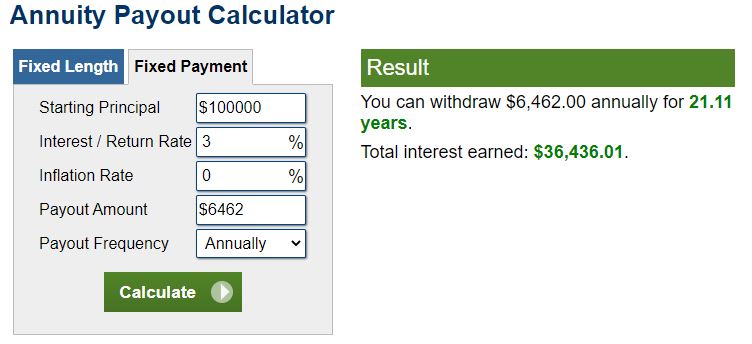

Another option, although a little riskier – would be utilizing both a CD or annuity, and Whole Life on a Forever Pay plan. In this case, the annual premium for $158,000 in whole life would be around $6462 a year. An annuity paying 3.0% interest, John could pull the whole life premium from the annuity for 21.11 years, or until age 91. If John passes away before age 91, his gift would be the $158,000 death benefit plus the remaining balance of the annuity. What if John lives past age 91 and can no longer afford the whole life premiums? That’s certainly a risk, but the safety net is that he could trigger the reduced paid up provision in the policy at that point.