Exploring Alternatives to Renewing My Certificate of Deposit

As my CD (Certificate of Deposit) matures this October, I’ve been asking: Are there better alternatives to simply rolling it over?

Looking Beyond CDs: Comparing with Single Premium Whole Life Insurance

CDs have traditionally been a go-to choice for retirees seeking safety and predictability. While they rarely generate impressive growth, they do provide a guaranteed return with very little risk. For individuals in retirement—who may not have decades to recover from market downturns—this stability has always been appealing.

That said, over the past 15–20 years, ultra-low interest had rates made CDs less attractive. Recent rate hikes have improved CD yields somewhat, but does that automatically make them the best solution today?

Not necessarily. Many people who invest in CDs think of that money as “never money.” By that, I mean:

-

Cash that’s liquid and readily available.

-

Funds not needed for daily living or planned spending.

-

Money they’d like to grow conservatively.

-

Assets ultimately intended for heirs or charity.

With those goals in mind, a CD may not always be the most efficient vehicle. In fact, for healthy individuals, a Single Premium Whole Life (SPWL) policy could provide greater long-term value.

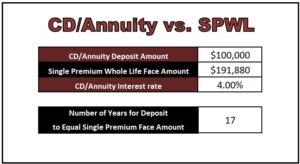

Example: $100,000 in a CD vs. a SPWL Policy

Let’s imagine Jane Doe, a healthy 64-year-old woman, who has $100,000 to allocate.

Option 1 – Single Premium Whole Life:

Jane applies for a policy with a one-time premium of $100,000. Upon approval, her death benefit is immediately $191,880. No matter when she passes—whether at age 64 or decades later—her beneficiaries would receive that amount, income-tax-free.

Option 2 – Certificate of Deposit:

Instead, Jane could put the $100,000 into a CD earning 4% annually. With compounding, her balance wouldn’t surpass the $191,880 death benefit until age 81—17 years later. If she lives beyond that, the CD works well, but if not, the life insurance leaves a much larger guaranteed legacy. (Also, a 17 year CD doesn’t exist.)

The Key Takeaway

We can’t predict how long we’ll live, but we can secure what we leave behind. A Single Premium Whole Life policy guarantees a legacy immediately, while a CD only catches up over time.

Comparison Snapshot:

-

Deposit: $100,000

-

SPWL Death Benefit: $191,880

-

CD Rate: 4%

-

Time for CD to catch up: 17 years (age 81)

If you’re in a similar situation to Jane—or if you’re thinking about long-term care, estate planning, final expenses, or wealth transfer—contact Frost-Beck Insurance Agencies to explore your options.